Credit Limit Optimization vs. Risk Management

Compare credit limit optimization and portfolio risk management — how data-driven limits, real-time monitoring, and insurance balance growth with protection.

Political Risk Insurance for Trade Credit

Compare PRI and ARI to protect trade receivables and investments in unstable markets – coverage, costs, and when to use each or both.

How Energy Sector Risks Impact Credit Insurance

Price swings, geopolitical disruption and insolvencies raise credit risk in energy; tailored credit insurance stabilizes cash flow and enables financing.

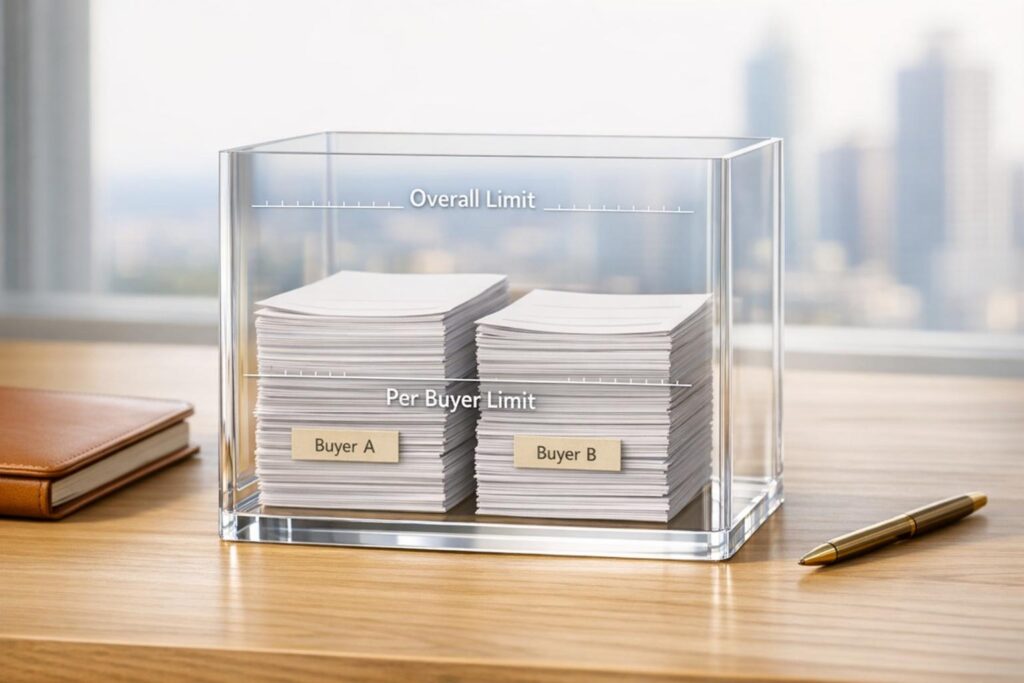

What Are Coverage Limits in Trade Credit Insurance?

Coverage limits define how much trade credit insurance pays per buyer and overall — essential for protecting cash flow, managing risk and improving financing.

Profitability Ratios for Credit Risk Analysis

How gross, operating and net margins plus ROA/ROE indicate creditworthiness, inform benchmarks, and shape trade credit insurance decisions.

Trade Credit Insurance for Banks

Trade credit insurance turns receivables into reliable collateral, cuts banks’ capital charges and unlocks larger lending capacity.

5 Best Practices for FX Risk in Global Trade

Five practical ways to cut currency exposure in international trade: forwards, diversification, natural hedges, risk-sharing and invoicing.

Global Trade Risks for Retailers: Insurance Solutions

How trade credit insurance protects retailers’ receivables from tariff shifts, supply disruptions, and buyer insolvency—coverage, costs, and policy options.

Why Construction Firms Need Trade Credit Insurance

How trade credit insurance shields construction firms from late payments, client insolvency, and cash-flow shocks while improving lending access and credit insights.

How Fintech Uses AI for Alternative Credit Data

How fintech uses AI and alternative data—rent, utilities, cash flow and digital footprints—to expand credit access, speed underwriting, and manage credit risk.