What is a Broker

Accounts Receivable Broker

An Accounts Receivable Broker is someone who is hired by you and paid by the insurance company. They have vast experience in dealing with a number of companies and a number of contracts. They simply make sure that you are placed with the best company and in the best contract, tailored to your unique business requirements. In order to ensure your broker has access to ALL markets, the letter below should be sent to ARI, on your letterhead, so that we can approach ALL appropriate markets for you.

Quotes for Credit Insurance

You will need the following to complete either application:

- Sales and loss information for the past 3 years;

- Largest single write off each year for the past 3 years;

- Buyer name(s), country, city, state, phone, and credit limit;

- Summary aging (descending high to low by open balance);

- List of Countries in which you do business.

Named Coverage Only Application

This is for companies that are interested in specific coverage for catastrophic losses (domestic and/or export). For example, you are interested in insuring ALL clients greater than $50,000. Please download and fill out the Named-Coverage-Application.pdf form below.

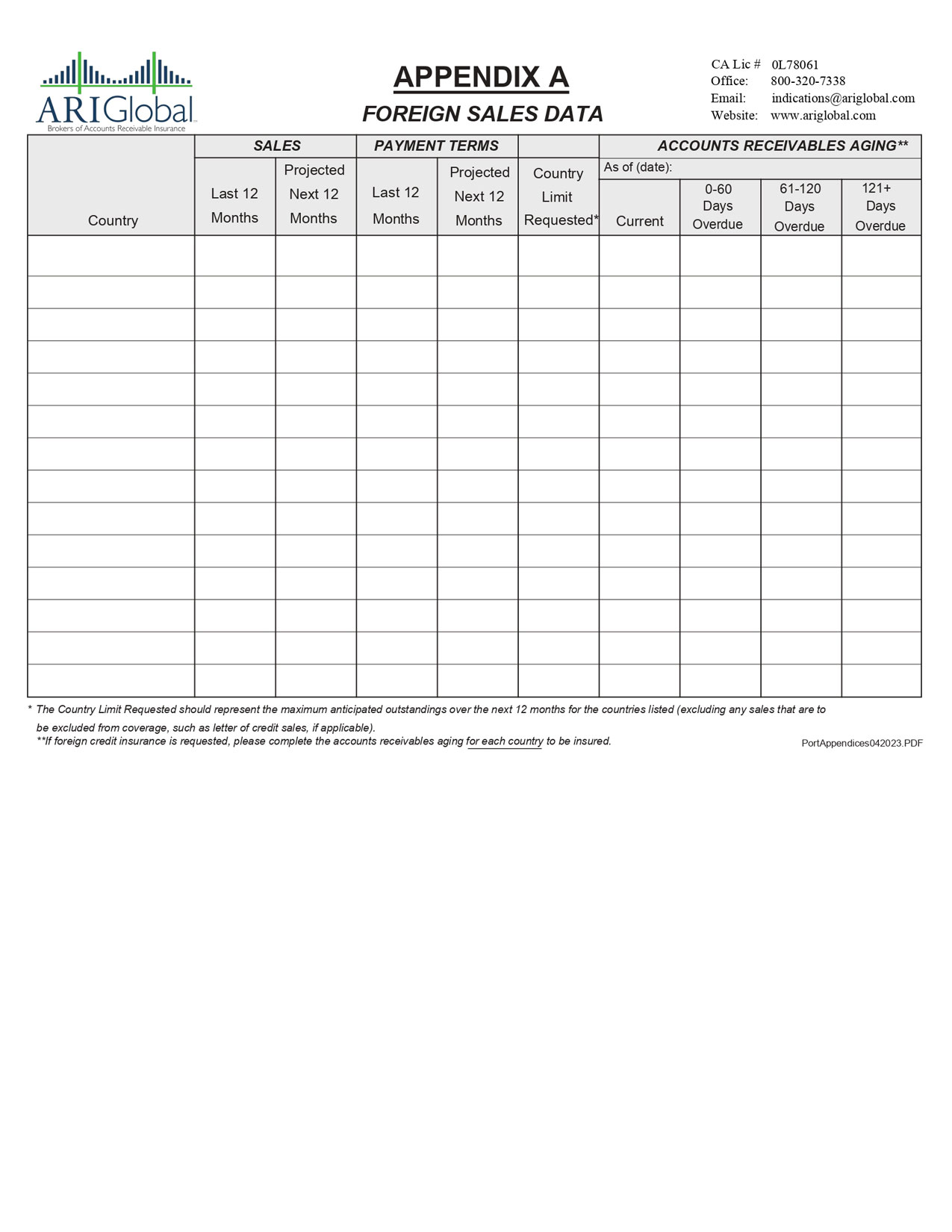

Portfolio Coverage Application

This is designed for clients interested in a portfolio of coverage. The insurance company will underwrite your credit policies, practices, and procedures and afford a discretionary limit that allows your credit department to ship up to that limit and still be covered. Amounts above the discretionary limit are specifically named on the policy. Please download and fill out the Portfolio-Coverage-Application.pdf and Portfolio-Appendicies.pdf forms below.

Single Debtor Only Application

This is for companies interested in covering one specific debtor, perhaps to satisfy a lending requirement due to a concentration, too much internal exposure or a new large opportunity with no prior trade experience. Minimum premium (approx. $20,000) is typically higher than multi-debtor (reasonable spread of risk) policies. Domestic coverage of approx. $1,000,000 typically maximizes the minimum premium. Export rates vary by country. Coverage for a feeble credit (negative tangible worth, deficit working capital, out of covenants of their bank loan, etc.) is generally a non-starter. Simply call us and we can speak to an underwriter prior to your completing the application.

100% Satisfaction Guarantee

If you are working on a direct basis, or with another broker, afford ARI the opportunity to support your Credit Insurance needs. If you feel at the end of the quotation process we were of no value, we will back out of the program and receive zero compensation.